Semiconductors: A word that has been in news for some time now; and more than just being in the news, they are affecting the automobile industry on a large scale. The idea is to understand how the whole semiconductor crisis has been impacting the production of the entire automobile industry.

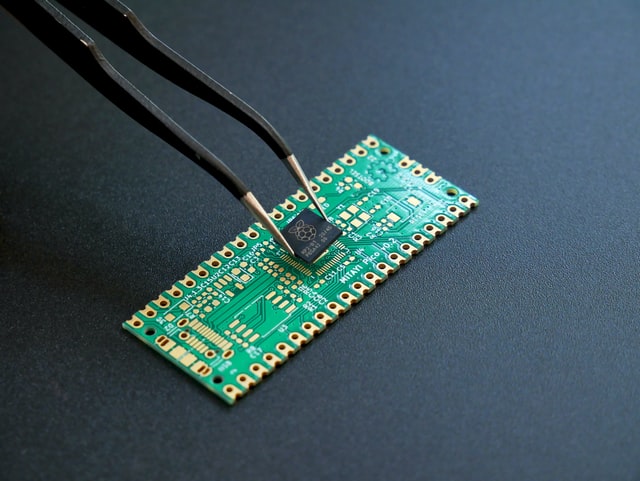

Semiconductors or chips (in common language) are a crucial element in the manufacturing of consumer electronics. In cars, these are needed for everything, from entertainment systems to power steering. The supply crunch and shortage of semiconductor chips has forced car manufacturers to cut production and delivery targets. This has led to a number of profit warnings.

In the simplest terms, the current semiconductor chip shortage is due to a strong demand and limited supply. This stems from the COVID-19 lockdown in the second quarter (Q2) of 2020, when demand for work-from-home technology increased exponentially. The whole shortage has been impacting different manufacturers throughout, for instance, production of laptops, tablets, smartphones and other electronic devices has been impacted by the shortage of semiconductors. During a post-earnings call with analysts, Apple CEO Tim Cook had said that “supply constraints will hurt sales of iPads and iPhones. Cook said the shortage is not in high-powered processors, but “legacy nodes,” or chips that perform functions like driving displays or decoding audio, which can be manufactured using older equipment. Same goes for the gaming consoles, as, despite high demand, PS5 is hard to find on store shelves or e-commerce websites, whereas PS4 was available in abundance during its first year on sale. This indeed adds to the whole idea of how important is the semiconductor industry for the electronics manufacturers.

As the demand grew, the automakers found themselves competing for the semiconductor capacity located in the Asian foundries, which paved the way to this new condition that has been affecting the industry since.

Present scenario

Let’s figure out the whole story in a rather comprehensive way: The car companies had to delay or cancel the orders during the first lockdown, but as production ramped up again, towards the end of 2020, there was limited semiconductor supply available. This was compounded by an increase in demand at the higher end of the autos market:

We can say that the COVID-19 pandemic has been the catalyst, but structural changes were also a major factor. The auto industry is changing with a major shift towards more tech oriented features and electric vehicles in recent times, which requires more chips, causing further strain on an already stretched industry.

To have a moment of relief, the number of semiconductor companies have increased throughout. As study by McKinsey, produced the data based on a range of macroeconomic assumptions suggesting the industry’s aggregate annual growth could average from 6 to 8 percent a year up to 2030. Some governments are also upping their investment in semiconductor technology to lessen the impact of global supply-chain disruptions. In India itself, there has been a massive amount of investment pool driven by the government itself, such as, the Indian government has approved a Rs 76,000-crore India Semiconductor Mission (ISM) to showcase its commitment to establishing a stronghold in the $533 billion semiconductor market. Seems like a perfect alternative for the shortage, yet the longevity of the problem still remains.

Seeing the present scenario, the chip shortage is unlikely to be completely resolved in the near future, partly because of the complexities of the semiconductor production process, which is a major case of concern for now. Switching to a different manufacturer also might not be a viable option, as switching typically adds another year or more because the chip’s design requires alterations to match the specific manufacturing process of a new partner. Moreover, some chips can contain manufacturer-specific intellectual property that may require alterations or licensing, adding to further increase the whole problems.

It is a known fact that the chip shortage is affecting many industries; however, the automotive sector has some unique characteristics that exacerbate the problem. For instance, many OEMs and Tier 1 suppliers follow a ‘just in time’ manufacturing strategy in which they order semiconductors and other vehicle components close to production to optimize inventory costs, which has, in turn, caused a new kind of problems for them. In the long run, it has been adding to the disruption of the vehicles sales and manufacturing. Other companies in the industry that do not follow a just-in-time ordering approach were in a better position, especially since some had secured extra capacity when automotive players cancelled or reduced their orders, creating a brief opportunity for the ones withholding the semiconductors.

While considering the demand side, the automotive companies have much more complex and personalised products than the companies in other industries, creating an immediate limitation of resources. In consequence, they may have more difficulty predicting their semiconductor needs, and demand may fluctuate. To top it all, the automotive industry needs to follow stringent safety requirements that necessitate the use of specifically validated semiconductors and defined production facilities along the complete value chain. This calls for some bigger actions to be taken while processing the decrease in the supply of semiconductors.

A steep climb ahead

To create an ample future for the manufacturing and supply of semiconductors, the geopolitical picture may significantly increase the global capacity to produce advanced chips. Legislation making its way through the US Senate would provide $52 billion in subsidies to increase the domestic chip production, which can provide for a greater mileage in terms of production and availability of the semiconductors. The US share of global chip production has fallen from 37 percent in the 1980s to 12 percent today. While chip shortages have been cited by those boosting subsidies, much of the money would go to reshoring production of advanced chips, draining a huge chunk of money in the process. As a matter of fact, semiconductor manufacturing giant Intel has expressed interest in setting up a new plant in India and is likely to apply for incentives under the new scheme to promote manufacturing for development of a sustainable semiconductor and display ecosystem. This could be a great leap into the future of semiconductor manufacturing for India.

How is the industry dealing with it?

Let’s see how the brands are coping up with this supply-and-demand situation of the semiconductors.

According to the J.P. Morgan’s report from December 2021, BMW expects chip supply to remain tight for another 6-12 months, with supply chain constraints lasting well into 2022, which seems like a well thought-out expectation. The Toyota Motor Corporation, on the other hand, announced a 40% cut in car and truck production around the world in October last year, due to the complications from a shortage of computer chips and COVID-19 restrictions affecting the production of parts in Southeast Asia. Honda has also said its production lines in Japan were operating at about 40% of its initial plan for the August-September 2021 period, while in October, the group was running 30% below previous plans, clearly demonstrating the whole crisis situation in the automobile industry.

Hopeful about the future

We all love our vehicles, be it as a means of transportation or a bundle of joy; and with the ongoing semiconductor shortage exceeding the expected time period, there might be a delay in production and sales of our beloved four wheels. With the world trying to find alternatives and improve the structural inadequacies, we are sure to figure out a way and get the manufacturing and sales of vehicles back to the usual or maybe even more than what we expect.

Cover Photo by Vishnu Mohanan on Unsplash