Introduction

If you have ever explored the premium automotive market in India, you have likely encountered a significant discrepancy between the advertised price and the final cheque you write. A luxury sedan with an ex-showroom price of 80 lakh INR can easily cost over 95 lakh INR by the time it is ready for your driveway. For the ultra-luxury segment, where vehicles are priced at 3 crore INR and above, this gap can expand by nearly 70 to 80 lakh INR.

This gap between the ex-showroom and on-road price is one of the most critical factors for luxury car buyers to understand. In the high-end segment, taxes and compliance costs scale exponentially, meaning a small percentage difference in state levies can result in a variation of several lakhs. This guide provides an exhaustive breakdown of these costs, updated for the 2026 tax landscape, to ensure your next acquisition is transparent, well-planned, and financially optimized.

What Is Ex-Showroom Price

The ex-showroom price is the base cost of the vehicle as it sits in the dealership before any state-level taxes or mandatory registration fees are applied. For luxury cars, this price is particularly high due to the sophisticated engineering, advanced technology, and the national tax structure. It is the price at which the dealer sells the vehicle to the customer, but it does not include the legal requirements for driving on public roads.

-

What Ex-Showroom Price Includes

- The manufacturing or import cost of the vehicle, including customs duties for Completely Built Units (CBU).

- Dealer and manufacturer profit margins.

- Goods and Services Tax (GST). Following recent reforms, most luxury cars and SUVs now fall under a high GST slab, which includes a base rate and a compensation cess for luxury goods.

- Basic warranty and standard equipment provided by the manufacturer.

-

What Ex-Showroom Price Does Not Include

- State road tax and RTO registration fees.

- Comprehensive motor insurance premiums.

- Tax Collected at Source (TCS).

- High-Security Registration Plates (HSRP) and FASTag.

- Optional extended warranties or service packages.

Manufacturers advertise the ex-showroom price because it is a stable figure across a specific region. Since on-road costs depend entirely on the state where you register the vehicle, providing a single final price in national brochures is virtually impossible.

What Is On-Road Price

The on-road price is the total legal cost of ownership. For a luxury buyer, this is the most important figure as it determines the actual cash outflow, the financing amount, and the insurance valuation. It is the final price that appears on your invoice after all government-mandated charges are added to the ex-showroom price.

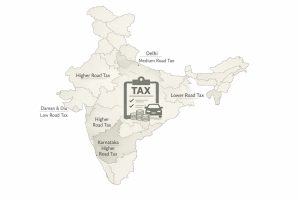

Unlike mass-market cars, luxury vehicles often face “luxury surcharges” in various states, making the on-road price significantly higher. For example, registering a high-displacement vehicle in Karnataka or Maharashtra will be substantially more expensive than in states with lower tax brackets like Himachal Pradesh or certain Union Territories. Furthermore, on-road prices fluctuate based on the choice of insurance add-ons, such as Return to Invoice (RTI) or Zero Depreciation cover, which are essential for high-value assets.

Detailed Breakdown of On-Road Price Components

Understanding the following pillars of automotive taxation will help you decode any dealer quote and identify areas where costs can be managed.

- Road Tax or RTO Charges This is typically the largest addition to a luxury car’s base price. Road tax is a state levy and for vehicles priced above 20 lakh INR, most states charge between 15 percent and 22 percent. Luxury SUVs often attract higher rates than sedans due to engine displacement and weight classifications. This tax is used by the state government for the maintenance of road infrastructure.

- Registration and Smart Card Fees While the road tax is a percentage of the car’s value, the registration fee itself is usually a fixed amount for the issuance of the Registration Certificate (RC) and the HSRP. In the luxury segment, these administrative costs are minor compared to the road tax, but they are mandatory for the legal identification of your vehicle.

- Comprehensive Insurance Insurance for luxury cars is notably higher due to the expensive spare parts and specialized repair labor. For a vehicle worth 1 crore INR, the annual premium can range from 2.5 lakh to 4.5 lakh INR depending on the inclusions. Most new luxury cars are sold with a “1 plus 3” policy: one year of Own Damage cover and three years of mandatory Third-Party cover. Luxury buyers should always opt for Zero Depreciation, Engine Protect, and Consumables cover to protect their investment.

- Tax Collected at Source (TCS) Under Section 206C of the Income Tax Act, any motor vehicle sale exceeding 10 lakh INR attracts a mandatory 1 percent TCS. This is a vital point for luxury buyers: while it adds to your upfront cost, this 1 percent is a tax credit that you can claim against your total income tax liability when filing your annual returns. It is essentially an advance tax payment rather than a permanent expense.

- Green Tax and Hypothecation Many states now levy a Green Tax on diesel vehicles with large engines to offset carbon footprints. Additionally, if you are financing the vehicle, a small hypothecation fee is paid to the RTO to record the bank’s lien on the registration document. Once the loan is paid off, you must pay another fee to remove this hypothecation.

Luxury Car On-Road Price Calculation Examples

Below are estimated breakdowns for popular luxury segments in 2026. These figures represent averages and can vary based on local municipal taxes or cess.

Example : The Executive Sedan (Model – ABC)

- Ex-Showroom Price: 80,00,000 INR

- Road Tax (Estimated 18 percent): 14,40,000 INR

- Insurance (Comprehensive with Add-ons): 3,50,000 INR

- TCS (1 percent): 80,000 INR

- Registration and Misc: 10,000 INR

- Total On-Road Price: 98,80,000 INR

Why On-Road Prices Vary Across India

The state of registration remains the biggest variable in your final bill. Karnataka and Maharashtra currently have some of the highest road taxes in the country for premium vehicles. Conversely, states like Delhi have historically offered zero road tax on Electric Vehicles (EVs), meaning a luxury EV like the Audi Q8 e-tron or BMW iX could have an on-road price much closer to its ex-showroom price compared to its petrol or diesel counterparts. This makes EVs a financially attractive proposition in the luxury segment for buyers in specific regions.

Expert Tips for Luxury Car Buyers

- Verify Insurance Quotes: Dealerships often bundle insurance with a significant markup. You are legally entitled to purchase insurance from any IRDAI-approved provider. By getting a quote from your own wealth manager or insurance broker, you can often save between 1 lakh and 3 lakh INR on a high-value car.

- Scrutinize Handling Charges: Many dealerships add “Depot Charges” or “Handling Charges” for the transportation of the car from the warehouse to the showroom. The Supreme Court of India and various RTOs have deemed these charges illegal as they should be included in the dealer’s margin.

- Explore the BH Series: If you are a transferable employee in the private sector (with offices in four or more states) or the public sector, registering your car under the BH (Bharat) series can drastically reduce your upfront cost. Instead of paying 15 years of road tax at once, you pay in manageable two-year increments.

- Year-End Benefits: Luxury manufacturers often offer “On-Road Support” during the months of November and December. This effectively means the manufacturer or dealer absorbs a portion of the road tax or insurance to clear current-year inventory.

Final Takeaway

In the world of high-end automobiles, the ex-showroom price is merely the opening figure in a complex financial narrative. For a seamless and prestigious buying experience, always insist on a transparent on-road breakup from your dealer early in the negotiation process. Understanding where every rupee goes, from state taxes to insurance premiums, ensures that you are paying for the machine and its engineering, not for hidden dealer margins or unnecessary markups.

At Motozite, we believe that luxury should be synonymous with transparency and informed decision-making. Our platform is dedicated to providing discerning buyers with deep insights into market trends, technical specifications, and real-world pricing structures. Stay ahead of the curve in the evolving Indian automotive landscape by following Motozite for expert analysis, the latest luxury launches, and comprehensive guides tailored for the premium car enthusiast.